SECURITIES AND EXCHANGE COMMISSION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant

☒ Filed by a Party other than the Registrant

☐Check the appropriate box:

| | |

Check the appropriate box: |

| |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to § 240.14a-12 |

Popular Income Plus Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | | | |

| | (5) | | |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) |

| | (1) | | |

| | |

| | (2) |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | |

| | (3) |

| | Filing Party:

|

| | |

(3) | | (4)Filing Party: |

| | |

| | (4) | | |

POPULAR INCOME PLUS FUND, INC.

BANCO

POPULAR CENTER,

208 Ponce de León NORTH BUILDING

Second Level (Fine Arts)

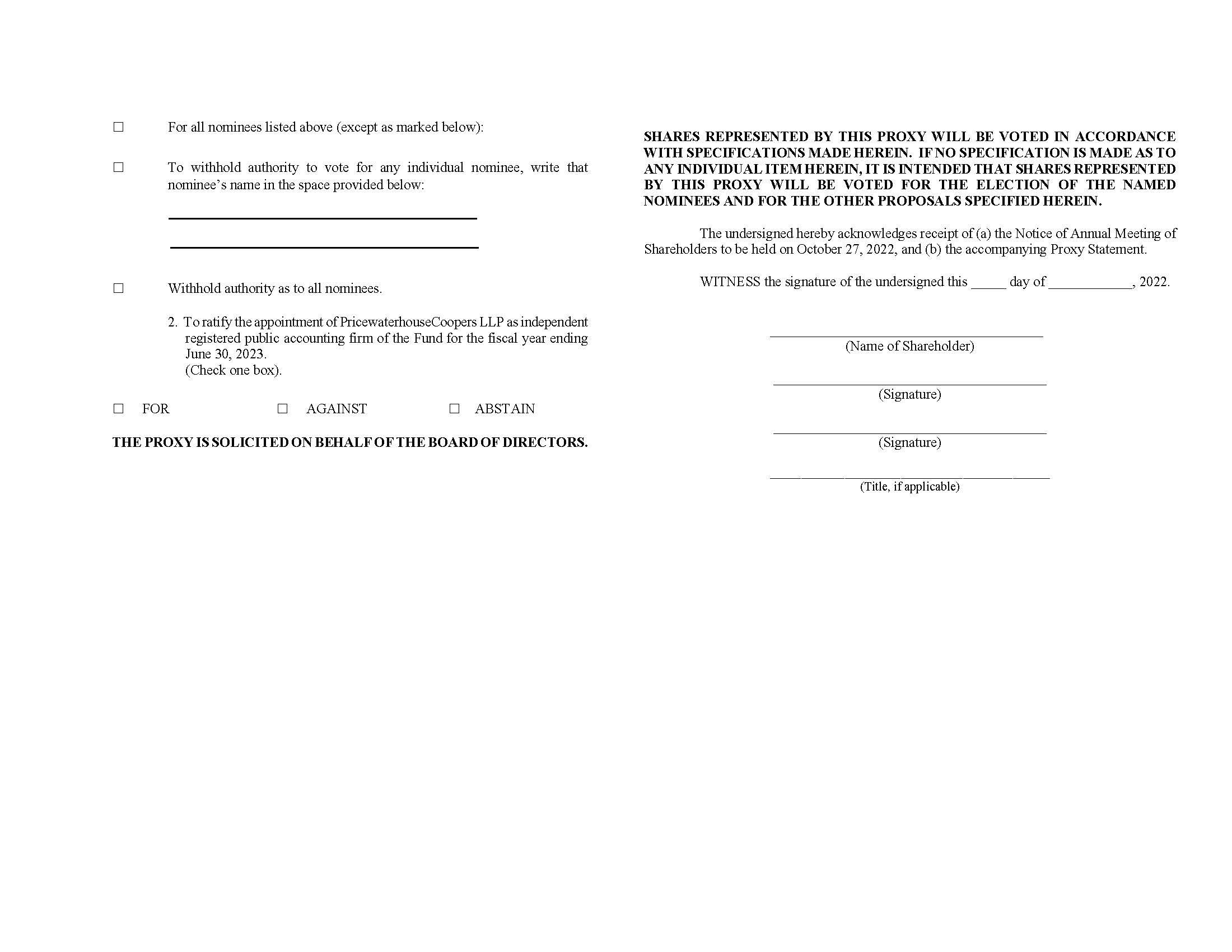

FOR ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON OCTOBER 27,

20212022

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors of Popular Income Plus Fund, Inc. (the “Fund”), a Puerto Rico corporation and an

open-end, non-diversified investment company registered under the U.S. Investment Company Act of 1940, as amended (the “1940 Act”), for use at the Annual Meeting of Shareholders to be held on October 27,

2021,2022, at

Banco Popular Center Lobby, Conference Hall

A,C, 208 Ponce de León Avenue, San Juan, Puerto Rico 00918 at 10:00 a.m., Atlantic Standard Time, or at any adjournment or postponement thereof (the “Meeting”). At the meeting, the shareholders of the Fund will consider and act upon the following proposals:

1. The election of four (4) directors of the Fund (

Proposal 1);

2. The ratification of the selection of PricewaterhouseCoopers, LLP as the Fund’s Independent Registered Public Accounting Firm for the fiscal year ending on June 30,

20222023 (

Proposal 2); and

3. Consideration and voting upon such other matters as properly may come before the Meeting or any adjournments thereof.

The close of business on

August 30, 2021September 1, 2022 has been fixed as the record date for the determination of shareholders entitled to notice of and to vote at the Meeting and all adjournments thereof.

The Fund will furnish, without charge, a copy of the Fund’s annual report to any shareholder upon request. Such requests should be directed to the Fund at Popular Center, North Building, North Tower, 4th Floor,Second Level (Fine Arts), 209 Muñoz Rivera Avenue, San Juan, Puerto Rico 00918, or by calling toll free at (787) 754-4488.

754-4488.Due to the public health impact of the coronavirus outbreak (COVID-19) and to support the health and well-being of shareholders of the Fund (collectively, the “Shareholders”), each person that attends the meeting in person will be required to comply with government guidelines then in effect, if any, including wearing a facemask or face covering and staying at least six feet from any other attendee at the Meeting.

Meeting, as applicable.

If you will be attending the Meeting in person, we respectfully request that you bring your brokerage-account statement and proxy card, along with a government-issued identification card—and, in the case of corporate, trust, custodian or estate accounts, a copy of a resolution designating you as an authorized representative of such account—in order to verify your identity for admittance to the Meeting. Failure to comply may result in your being denied admittance to the Meeting. Only the registered shareholder—or, in the case of corporate, trust, custodian or estate accounts, a single representative of the registered shareholder—may attend the Meeting.

In addition to the solicitation of proxies by mail, officers of the Fund and officers and regular employees of

Banco Popular de Puerto Rico (“Banco Popular”)ALPS Fund Services, Inc., the Fund’s administrator (in such capacity, the “Administrator”), affiliates of Banco Popular

de Puerto Rico (“Banco Popular”), and/or other representatives of the Fund may also solicit proxies by telephone, telefax or in person. The costs of solicitation and the expenses incurred in connection with preparing this Proxy Statement and its enclosures will be paid by the Fund. The Fund will reimburse brokerage firms and others for their expenses in forwarding solicitation materials to the beneficial owners of shares. This Proxy Statement is expected to be mailed to Shareholders on or about

September 17, 2021.October 5, 2022.

If the enclosed proxy is executed and returned in time to be voted at the Meeting, the shares represented thereby will be voted in accordance with the instructions marked thereon. Unless instructions to the contrary are marked thereon, the proxy will be voted “FOR” the election of the Directors of the Fund, “FOR” the ratification of the selection of the independent registered public accounting firm, and “FOR” any other matters deemed appropriate. Any Shareholder who has given a proxy has the right to revoke it at any time prior to its exercise, either by attending the Meeting and voting his or her shares of common stock (“Shares”) in person or by submitting a letter of revocation or a later-dated proxy to the Fund at the above address prior to the date of the Meeting.

The presence at the Meeting, in person or by proxy, of the holders of

one-third of the outstanding Shares of the Class A common stock and Class C common stock, taken together as a single class, will constitute a quorum at the Meeting. For purposes of determining the presence of a quorum for transacting business at the Meeting, abstentions and “broker

non-votes” (that is, a proxy from a broker or nominee indicating that such person has declined to exercise its discretionary authority on a particular matter with respect to which the broker or nominee has discretionary power) will be treated as Shares that are present at the Meeting but that have not been voted. In the event that a quorum is not present at the Meeting, or in the event that a quorum is present but sufficient votes to approve any of the proposals are not received, the persons named as proxies may propose one or more adjournments of the Meeting to permit further solicitations of proxies. In determining whether to adjourn the Meeting, the following factors will be considered: the nature of the proposals that are the subject of the Meeting; the percentage of votes actually cast; the percentage of negative votes actually cast; the nature of any further solicitation; and the information to be provided to Shareholders with respect to the reasons for the solicitation. Any adjournment will require the affirmative vote of a majority of the Shares represented at the Meeting in person or by proxy. A shareholder vote may be taken on the proposals in this Proxy Statement prior to such adjournment if sufficient votes have been received and it is otherwise appropriate.

Approval of the election of the four Board Nominees as Directors of the Fund contemplated in Proposal 1 below requires the affirmative plurality vote of the outstanding Shares present at the Meeting, in person or by proxy. Approval of the ratification of the selection of the Independent Registered Public Accounting Firm contemplated in Proposal 2 below requires the affirmative vote of the majority of the outstanding Shares present at the Meeting, in person or by proxy.

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

The close of business on

August 30, 2021September 1, 2022 has been fixed as the record date for the determination of Shareholders entitled to notice of and to vote at the Meeting and all adjournments thereof (the “Record Date”).

Each Shareholder is entitled to one vote for each full share and an appropriate fraction of a vote for each fractional share held. The Class A Shares and Class C Shares vote together as a single class. On the Record Date, there were

5,506,358 and 5,233,6515,180,933.798 Class A Shares and

4,853,298.265 Class C Shares outstanding, respectively.

As of

August 30, 2021, 3,586,590 and 1,548,353September 1, 2022, 3,243,961.58 Class A

Shares and

1,509,856.92 Class C Shares, respectively, were held of record by National Financial Services, Inc., as clearing agent for Popular Securities, LLC, representing approximately

273243 and

164, respectively,155 brokerage

accounts; 484,418accounts, respectively; 465,042.24 Class A

sharesShares were held of record by Merrill Lynch

Pierce Fenner & Smith, representing

38approximately 37 brokerage accounts; and

1,164,673 and 3,544,5741,198,338.90 Class A

Shares and

3,211,012.84 Class C

shares,Shares, respectively, were held of record by Pershing LLC representing approximately

8480 and

268, respectively,245 brokerage

accounts.accounts, respectively.

PROPOSAL 1: ELECTION OF DIRECTORS OF THE FUND

The purpose of Proposal 1 is to elect four (4) members of the Board of Directors of the Fund.

Nominees for the Board of Directors of the Fund

The Board of Directors of the Fund (the “Board”) currently consists of the following four individuals (each, a “Director”): Juan O. Guerrero Preston, Enrique Vila del Corral, Jorge Vallejo and Carlos Pérez. Of the four current Directors of the Fund, three Directors, Enrique Vila del Corral, Jorge Vallejo and Carlos Pérez, are not “interested persons” of the Fund as defined in the 1940 Act (the “Independent Directors”). Juan O. Guerrero Preston is the Chairman of the Board and is considered an “interested person” of the Fund as such term is defined in Section 2(a)(19) of the 1940 Act (the “Interested Director”) because of his affiliation with the Fund’s investment adviser, Popular Asset Management LLC (the “Adviser”). All four current Directors are standing for

re-election (each, a “Board Nominee”). The Board Nominees elected

at the meeting will serve from the time of their election until their respective successors are elected and qualified or until their earlier death or removal.

All of the Board Nominees currently serve as Directors of the Fund and all were previously elected by the Shareholders of the Fund. The Board Nominees were recommended by the Independent Directors. Each of the Board Nominees has consented to being named in this Proxy Statement and to serve as a Director if elected.

Directors’/Nominees’ Biographical Information

The table below identifies the Board Nominees and sets forth certain biographical and other information relating to the Board Nominees. Such information includes each Board Nominee’s address and year of birth, principal occupations for at least the last five years, length of time served, total number of registered investment companies and investment portfolios overseen in the Popular complex (the “Popular Family of Funds”) and any currently held public company and other investment company directorships. Each Board Nominee was nominated unanimously by the Directors of the Fund. Juan O. Guerrero Preston was selected to serve as the Chairman of the Board.

| | | | | | | | |

Year of Birth | | (Length of

Service) | | Principal Occupation(s) During the Past Five Years | | Overseen | | the Past Five Years |

Interested Directors |

Banco Popular de Puerto Rico, 208 Ponce de Leon Ave., Banco Popular Center, 3rd Floor, San Juan, Puerto Rico 00918 | | Chairman of the Board and President (since 2012) and Director (since 2001) | | Executive Vice President of Banco Popular overseeing the Financial and Insurance Services Group since April 2004; Director of the Popular Family of Funds since 2001; Director of various wholly-owned subsidiaries of Popular, Inc.; Director of SER de Puerto Rico since December 2010; and Director of Puerto Rico Baseball Academy and High School until December 2016. | | 3 | | None |

Independent Directors |

Professional Offices Park ROC Company Building, Carr. San Roberto #1000, Rio Piedras, PR 00926 | | | | Private Investor since 2001; Managing Partner of various special partnerships involved in real estate development and leasing of commercial office space; Director of Popular Family of Funds and Puerto Rico Residents Investors Tax-Free Family of Funds; Director of V. Suarez Group of Companies. | | 3 | | None71 |

Vallejo &Vallejo, 1610 Ponce de León Ave., Parada 23, Santurce, PR 00912 | | | | Managing Partner of Vallejo & Vallejo, a real estate appraisal and consulting firm in San Juan Puerto Rico, from April 1992 to 2020; Director of Popular Family of Funds and Puerto Rico Residents Investors Tax-Free Family of Funds. | | 3 | | None71 |

Pediatrix Medical Group, Metro Office Park #6 (Edif. Toshiba) Calle 1 Suite 202, Guaynabo, PR 00968 | | | | President of the Caribbean and Latin American Region of Pediatrix Medical Group since 2002; Director of the University of Puerto Rico’s Hospital of Carolina since September 2013; | | 3 | | None |

| | | | | | | | |

Toshiba) Calle 1

Suite 202, Guaynabo,

PR 00968

(1953)

| | | | Member of the Board of Trustees of the University of Puerto Rico from 2014 to 2017; Director of Popular Family of Funds. | 3 | | | None |

1 The Investment Companies are as follows: Puerto Rico Residents Tax Free Fund I, Inc., Puerto Rico Residents Tax Free Fund II, Inc., Puerto Rico Residents Tax Free Fund III, Inc., Puerto Rico Residents Tax Free Fund IV, Inc., Puerto Rico Residents Tax Free Fund V, Inc., Puerto Rico Residents Tax Free Fund VI, Inc. and Puerto Rico Residents Bond Fund I, Inc.

Based on each Board Nominee’s experience, qualifications, attributes or skills on an individual basis and in combination with those of the other Board Nominees, each Board Nominee should serve as a Director of the Board. Among the attributes common to all Board Nominees are their ability to review critically, evaluate, question and discuss information provided to them, to interact effectively with the Adviser, other service providers, counsel and the independent registered public accounting firm, and to exercise effective business judgment in the performance of their duties as Directors. A Director’s ability to perform his or her duties effectively may have been attained through such Director’s educational background or professional training; business, consulting, public service or academic positions; experience from service as a Director of the Fund and the other funds in the Popular Family of Funds (and any predecessor funds), other investment funds, public companies, or

non-profit entities or other organizations; and/or other life experiences.

In particular, Mr. Guerrero’s executive leadership and broad understanding of the financial services industry in Puerto Rico as a result of his experience as an executive, along with his considerable board experience, which includes service on boards of the Popular Family of Funds, SER de Puerto Rico and other private and

non-profit entities provides the Board with a broad knowledge base. Mr. Vila’s vast experience and understanding of accounting and finance principles are strong attributes for the Board and provide critical insight into financial matters to the Board. Mr. Vallejo’s profound understanding of the Puerto Rico real estate market and his extensive board experience, which includes services on board of the Popular Family of Funds and the Puerto Rico

Residents Investors Tax-Free Family of Funds is of great benefit to the Board’s initiatives. Finally, Dr. Perez’s experience as an executive of a regional medical group and his experience as a director of both public and private entities provide a depth of experience for the Board.

Based on the discussion of the specific experience, qualifications, attributes or skills of each Director set forth above, the Board has concluded that each of the Board Nominees should continue to serve as Directors of the Fund.

Board Leadership Structure and Oversight

The Board currently consists of four Directors, three of whom are Independent Directors. The Board has overall responsibility for the oversight of the Fund. Among other things, the Directors (i)

monitor the quality of the advisory services provided by the Adviser; (ii)

review annually the fees paid to the Adviser for its services; (iii)

monitor potential conflicts of interest between the Fund and the Adviser; (iv)

monitor distribution activities, custody of assets and the valuation of securities; and (v)

oversee the Fund’s compliance program. In performing their duties, Directors receive detailed information about the Fund and the Adviser on a regular basis and meet at least quarterly with management of the Adviser to review reports relating to the Fund’s operations. The Directors’ role is to provide oversight and not to provide day-to-day management. management.

The Board has engaged the Adviser to manage the Fund on a

day-to-day basis. The Board is responsible for overseeing the Adviser, other service providers, the operations of the Fund and associated risks in accordance with the provisions of the 1940 Act, Puerto Rico law, other applicable laws, the Fund’s charter, and the Fund’s investment objectives and strategies. The Board reviews, on an ongoing basis, the Fund’s performance, operations and investment strategies and techniques. The Board also conducts reviews of the Adviser and its role in running the operations of the Fund.

The Board has one (1) standing Committee: the Audit Committee. The Chairman of the Audit Committee, Enrique Vila del Corral, is an Independent Director.

The Chairman of the Board, Juan O. Guerrero Preston, is an “interested person” of the Fund as that term is defined under Section 2(a)(19) of the 1940 Act because of his affiliation with the Adviser. The remaining Directors and their immediate family members have no affiliation or business connection with the Adviser, the Fund’s principal underwriter (Popular Securities, LLC) or any of their affiliated persons, and they do not own any stock or other securities issued by the Adviser or the Fund’s principal underwriter.

The role of the Chairman of the Board is to preside at all meetings of the Board and to act as a liaison with service providers, officers, attorneys and other Directors generally between meetings. The Chairman of the Audit Committee

performs a similar role with respect to the Audit Committee. The Chairman of the Board and the Chairman of the Audit Committee may also perform such other functions as may be delegated by the Board or the Audit Committee, respectively, from time to time.

The Board has regular meetings four times a year and may hold special meetings if required before their next regular meeting. The Audit Committee meets regularly to conduct the oversight functions delegated to the Audit Committee by the Board and reports its findings to the Board.

The Independent Directors have not designated a lead Independent Director, but the Chairman of the Audit Committee of the Fund generally acts as chairman of meetings or executive sessions of the Independent Directors and, when appropriate, represents the views of the Independent Directors to the Fund’s management. The Board has determined that its leadership structure is appropriate for the Fund because it enables the Board to exercise informed and independent judgment over matters under its purview, allocates responsibility to the Audit Committee in a manner that fosters effective oversight, and allows the Board to devote appropriate resources to specific issues in a flexible manner as they arise. The Board periodically reviews its leadership structure as well as its overall structure, composition and functioning and may make changes in its discretion at any time.

Compensation of Directors

No officer, director or employee of the Adviser or of any affiliate thereof receives any compensation from the Fund for serving as an officer or Director of the Fund. Therefore, given that the Chairman of the Board, Juan O. Guerrero Preston, is an “interested person” of the Fund under the 1940 Act because of his affiliation with the Adviser, he does not receive any compensation from the Fund. The Fund pays each Director who is not an “interested person” of the Fund under the 1940 Act a fee of $1,000 per board and committee meeting attended, together with such Director’s actual travel and

out-of-pocket expenses relating to attendance at meetings.

The following table sets forth the aggregate compensation paid by the Fund to its

non-interested Directors for the fiscal year ended June 30,

20212022 and the total compensation paid to such Directors by all investment companies advised or

co-advised by the Adviser (the “Fund Complex”) for the calendar year ended December 31,

2020.2021. The Fund does not accrue any retirement benefits for its Directors as part of its expenses.

| | | | |

Name of Non-Affiliated

Director | | Aggregate Compensation

from Fund(1) | | Total Compensation from all

Funds Advised or Co-Advised

by Adviser(2) |

Enrique Vila del Corral | | $7,322.33 | | $71,000.00 |

Carlos Perez | | $7,322.33 | | $29,500.00 |

Jorge Vallejo | | $7,322.33 | | $63,000.00 |

(1) | For the fiscal year ended June 30, 2021.

|

(2) | For the calendar year ended December 31, 2020.

|

| | Aggregate Compensation from Fund(1) | | Total Compensation from all Funds Advised or Co-Advised by Adviser(2) |

| Enrique Vila del Corral | | $6,334.00 | | $110,250.00 |

| Carlos Perez | | $6,334.00 | | $28,500.00 |

| Jorge Vallejo | | $6,334.00 | | $103,700.00 |

(1)For the fiscal year ended June 30, 2022. (2)For the calendar year ended December 31, 2021.

Shares Owned by the Board Nominees

Information relating to each Board Nominee’s Share ownership in the Fund and in all registered investment companies in the Fund Complex that are currently overseen by each respective Director (the “Supervised Funds”) as of December 31,

20202021 is set forth in the chart below.

| | | | |

| | Dollar Range

of Equity Securities

in Fund

| | Aggregate Dollar Range

of Equity Securities

in Supervised Funds

|

Enrique Vila del Corral | | | | |

| | |

Carlos Perez | | $1 –$10,000 | | $1 – $10,000 |

| | |

Jorge Vallejo

| | None | | None |

| | |

Juan O. Guerrero Preston

| | $1 – $10,000 | | $1 – $10,000 |

| Jorge Vallejo | | $10,000 – $50,000 | | $10,000 – $50,000 |

| Juan O. Guerrero Preston | | | | |

As of June 30,

2021,2022, none of the Independent Directors of the Fund or their immediate family members owned beneficially or of record any securities of the Fund’s Adviser or principal underwriter, or of any person directly or indirectly controlling, controlled by, or under common control with such entities.

Attendance of Directors at Shareholders’ Meetings

The Fund currently does not have a formal policy regarding Director’s attendance at Shareholder meetings. During the last fiscal year, the Fund held a Shareholder meeting on October

28, 202027, 2021 at which 1 Director attended.

Shareholder Communications

The Board has established a process for shareholders to communicate with the Board. Shareholders may contact the Board by mail. Correspondence should be addressed to

Fund at Popular Center, Building, North Tower, 4Building,thSecond Floor (Fine Arts), 209 Muñoz Rivera Avenue San Juan, Puerto Rico 00918. Shareholder communication to the Board should include the following information: (a) the name and address of the shareholder; (b) the number of shares owned by the shareholder; (c) the Fund of which the shareholder owns shares; and (d) if these shares are owned indirectly through a broker, financial intermediary or other record owner, the name of the broker, financial intermediary or other record owner. All correspondence received as set forth above shall be reviewed by the Secretary of the Fund and reported to the Board.

The Board met a total of

eight (8)5 times during the Fund’s most recent fiscal year, of which

four (4)4 were regular meetings and

four (4) were1 was a special

meetings.meeting. Each of the Directors attended at least 75% of the aggregate number of meetings held by the Board during the most recent fiscal year.

Standing Committees of the Board

The Board has one (1) standing Committee: the Audit Committee. The members of the Audit Committee of the Fund are Enrique Vila del Corral, Jorge Vallejo and Carlos Pérez, each of whom is an Independent Director. The responsibilities of the Audit Committee are to approve, and recommend to the Board the approval, the selection, retention, termination and compensation of the Fund’s independent registered public accounting firm (the “Independent Registered Public Accounting Firm”) and to oversee the Independent Registered Public Accounting Firm’s work. The Audit Committee met two (2)2 times during the Fund’s most recent fiscal year. The Board has elected not to have a standing Nominating Committee due to the Board’s small size. Therefore, responsibilities typically delegated to a Nominating Committee are handled by the Board as a whole which identifies and evaluates nominees in accordance with the Fund’s by-laws. In addition, the Board handles any persons nominated for election as directors by a Shareholder in accordance with the process and requirements outlined in the Fund’s by-laws.

The following is a list of the current executive officers of the Fund, all of whom have been elected by the Directors to serve until their respective successors are elected and who also serve in the same capacity for the other Funds in the Popular Family of Funds:

| | | | |

Year of Birth | |

Position(s) Held with the Funds

(Length of Service) | | Principal Occupation(s) During the Past Five Years |

| | |

Banco Popular de Puerto Rico, 208 Ponce de Leon Ave., BancoPopular Center, 3rd Floor, San Juan, Puerto Rico 00918 (1959) | | Chairman of the Board and President (since 2012) and Director (since

2001) | | (See table of Directors on page 3.4.) |

| | |

Banco Popular de Puerto Rico, 208 Ponce de Leon Ave., BancoPopular Center, North Tower 4th Floor, San Juan, Puerto Rico 00918 (1978) | | Treasurer (since 2018) | | Mr. González has been in charge of Banco Popular’s Mutual Funds’ Administration Division since 2014 and of Popular’s Fiduciary Services Operations since 2019. Mr. González has also been a Vice President of Banco Popular since 2014. Prior to joining Banco Popular, Mr. González was a Vice President, Treasurer and Fund Administration and Operations Manager for Santander Asset Management’s First Puerto Rico Family of Funds. He also served as Vice President, Operations Manager and Trust Officer of Banco Santander from 2004 to 2008. |

| | |

José A. Chang

Banco Popular de Puerto Rico,

153 Ponce de León Ave., Popular

Street Building 11th Floor,

San Juan, Puerto Rico 00918

(1962)

| | |

Lucas Foss SS&C 1290 Broadway, Suite 100 Denver, Colorado 80203 (1977) | Chief Compliance Officer (since 2007)

(since 2021) | | Mr. ChangFoss has been Banco Popular’sthe Chief Compliance Officer of for the Popular Family of Funds and Puerto Rico Residents Tax-Free Funds and a Manager andsince 2021. Mr. Foss currently serves as Vice President and Fund Chief Compliance Officer at SS&C/ALPS Fund Services, Inc. Prior to joining ALPS in November 2017, Mr. Foss served as the Director of Popular’s Corporate Compliance Division since 2007. Mr. Chang is currently the Manager and Vice President of Popular’s Corporate Financial Compliance and has been with Banco Popular since 2001.at Transamerica Asset Management beginning in July 2014. |

| | |

Manuel Rodríguez Boissén, Esq. Pietrantoni Méndez & Alvarez LLC, 208 Ponce de Leon Ave., Banco Popular Center, 19th Floor, San Juan, Puerto Rico 00918 (1977) | | Secretary (2018)(since 2018) | | Mr. Rodríguez-Boissén has been an attorney at Pietrantoni Mendez & Alvarez LLC, legal counsel to the Fund, since 2002 and a Member since 2012. Mr. Rodríguez-Boissén’s practice focuses on public-private partnerships, corporate and public finance and regulatory compliance for clients engaged in the financial services industry, including the Popular Family of Funds. |

Approval of the election of the four Board Nominees as Directors of the Fund requires the affirmative plurality vote of the outstanding Shares present at the Meeting, in person or by proxy.

THE BOARD OF DIRECTORS, INCLUDING THE “INDEPENDENT DIRECTORS,” UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE PROPOSAL TO ELECT THE FOUR BOARD NOMINEES AS DIRECTORS OF THE FUND.

PROPOSAL 2: RATIFICATION OF THE SELECTION OF THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee has selected PricewaterhouseCoopers, LLP (the “Auditor”), with offices located at

San Juan, Puerto Rico, as the Fund’s Independent Registered Public Accounting Firm for the fiscal year ending June 30,

2022.

2023. The Independent Registered Public Accounting Firm is responsible for auditing the financial statements of the Fund. The Board considers the selection of the Independent Registered Public Accounting Firm to be an important matter of Shareholder concern and is submitting the selection of the Auditor for ratification by the Shareholders.

Independent Registered Public Accounting Firm Fees and Other Matters

The table below shows the amounts paid by the Fund to the Auditor for accounting services for the periods indicated:

| | | | | | |

| | | Fees Paid to the Auditor for the Fiscal Year Ended June 30, |

| | | 2020 | | 2019 | | 2018 |

Popular Income Plus Fund | | $60,481.67 | | $60,481.67 | | $58,823.67 |

| | Fees Paid to the Auditor for the Fiscal Year Ended June 30, |

| | 2022 | 2021 | 2020 |

| Popular Income Plus Fund | $62,482.00 | $66,000.00 | $38,391.00 |

Audit Committee’s

Pre-Approval Policies and Procedures

The Audit Committee of the Fund complies with applicable laws and regulations with regards to the

pre-approval of services. Audit, audit-related and tax compliance services provided to the Fund on an annual basis require specific

pre-approval by the Fund’s Audit Committee. As noted above, the Fund’s Audit Committee must also approve other

non-audit services provided by the Fund’s Independent Registered Public Accounting Firm to the Fund and to the Fund’s Adviser that relate directly to the operations and financial reporting of the Fund.

Approval of the ratification of the selection of the Independent Registered Public Accounting Firm requires the affirmative vote of the majority of the outstanding Shares present at the Meeting, in person or by proxy.

THE BOARD OF DIRECTORS, INCLUDING THE “INDEPENDENT DIRECTORS,” UNANIMOUSLY RECOMMENDS THAT THE SHAREHOLDERS VOTE “FOR” THE PROPOSAL TO RATIFY THE SELECTION OF THE FUND’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

Broker Discretionary Votes, Broker

Non-Votes and Abstentions

Proposal 1 and Proposal 2 are considered “routine” proposals and thus

broker discretionary votes will be allowed. A broker discretionary vote is a proxy ballot that a broker may cast on behalf of the Shareholder if such Shareholder does not provide the broker with a specific voting instruction. A broker may vote your Shares to the extent such broker (i) has transmitted this proxy and all related soliciting material to you, (ii) exercises investment discretion for you pursuant to an advisory contract, (iii) has been designated in writing by you to receive soliciting material; and (iv) has not received instruction from you as to how to vote your Shares.

Abstentions and “broker

non-votes” (non-votes”i.e. (i.e., a proxy from a broker or nominee indicating that such person has declined to exercise its discretionary authority on a particular matter with respect to which the broker or nominee has discretionary power) will be treated as Shares that are present at the Meeting for purposes of determining the presence of a quorum for transacting business at the Meeting but that have not been voted. If a proxy that is properly executed and returned by a broker and such broker has declined to exercise its discretion to vote represents a “broker

non-vote,” the Shares represented thereby will be considered to be present at the Meeting for purposes of determining the existence of a quorum for the transaction of business but will not have an effect on the vote of the proposals requiring either a plurality

vote or majority vote of the outstanding shares present at the meeting because such “broker non-votes” are not entitled to vote on such matters. If a proxy that is properly executed and returned is unmarked or marked with an abstention (collectively “Abstentions”) and the vote required for the proposal is a plurality vote of the outstanding shares present at the meeting, such Shares will have no effect on the outcome of the vote. If a proxy that is properly executed and returned is unmarked or marked with an Abstention and the vote required for the proposal is a majority vote of the outstanding shares present and the meeting, such Shares will be treated as a vote “against” the proposal.

Accordingly,

broker-non-votes will not be counted in determining the number of Shares necessary for approval of Proposal 1 and Proposal 2 and will not have an impact on the vote of such proposals. Abstentions will have the same effect as a vote “against” Proposal 1. Abstentions will not have an impact on the vote for Proposal 2.

Unless instructions to the contrary are marked thereon, the Proxy will be voted “FOR” the election of the Directors of the Fund, “FOR” the ratification of the selection of the independent registered public accounting firm of the Fund, and “FOR” any other matters deemed appropriate. Approval of Proposal 1 requires the affirmative plurality vote of the outstanding Shares present at the Meeting, in person or by proxy. Approval of Proposal 2 requires the affirmative vote of the majority of the outstanding Shares present at the Meeting, in person or by proxy. Broker

non-votes will not have an effect on the vote of such proposals. Abstentions will have the effect of a vote “against” Proposal 1 and will not have an effect on the vote of Proposal 2. Each proposal is an independent proposal and is not contingent on the adoption of another proposal.

Investment Adviser, Administrator and Distributor

The address of the Adviser is: Popular Asset Management LLC,

Fourth Floor, Banco Popular Center, North

Tower, 208 Ponce de LeónBuilding, Second Level (Fine Arts), 209 Muñoz Rivera Avenue, San Juan, Puerto Rico 00918. The address of the Administrator is:

Banco Popular de Puerto Rico, Fourth Floor, Banco Popular Center, North Tower, 208 Ponce de León Avenue, San Juan, Puerto Rico 00918.ALPS Fund Services, Inc., 1290 Broadway Suite 1000, Denver, Colorado 80203. The address of the Distributor is: Popular Securities, LLC, Twelfth Floor,

Banco Popular Center Building, 208 Ponce de León Avenue, San Juan, Puerto Rico 00918.

OTHER MATTERS TO COME BEFORE THE MEETING

The Directors do not intend to present any other business at the Meeting, nor are they aware that any Shareholder intends to do so. If, however, any other matters are properly brought before the Meeting, in accordance with the

Fund’s Fund's By-Laws, the persons named in the accompanying form of proxy will vote thereon in accordance with their judgment.

As provided for in the Fund’s

By-Laws, at any annual or special meeting of Shareholders, proposals by Shareholders and persons nominated for election as Directors by Shareholders shall be considered only if advance notice thereof has been timely given as provided herein and such proposals or nominations are otherwise proper for consideration under applicable law and the Certificate of Incorporation and

By-Laws of the Fund. Notice of any proposal to be presented by any Shareholder including the nomination of any person by any Shareholder for election as a Director of the Fund at any meeting of Shareholders shall be delivered to the Secretary of the Fund at its principal executive office not less than thirty (30) nor more than fifty (50) days prior to the date of the meeting;

provided, however, that if the date of the meeting is first publicly announced or disclosed less than forty (40) days prior to the date of the meeting, such notice shall be given not more than ten (10) days after such date is first so announced or disclosed. Public notice shall be deemed to have been given more than forty (40) days in advance of the annual meeting if the Fund shall have previously disclosed, in the Fund’s

By-Laws or otherwise, that the annual meeting in each year is to be held on a determinable date, unless and until the Board determines to hold the meeting on a different date. Any Shareholder who gives notice of any such proposal shall deliver therewith the text of the proposal to be presented and a brief written statement of the reasons why such Shareholder favors the proposal and setting forth such

Shareholder’sShareholder's name and address, the number and class of all Shares of each class of stock of the Fund beneficially owned by such Shareholder and any material interest of such Shareholder in the proposal (other than as a Shareholder). Any Shareholder desiring to nominate any person for election as a Director of the Fund shall deliver with such notice a statement in writing setting

forth the name of the person to be nominated, the number and class of all Shares of the Fund beneficially owned by such person, the information regarding such person as would be required by paragraphs (a), (e) and (f) of Item 401 of Regulation S-K adopted by the Securities and Exchange Commission (or the corresponding provisions of any regulation subsequently adopted by the Securities and Exchange Commission), such person’s signed consent to serve as a Director of the Fund if elected, such Shareholder’sShareholder's name and address and the number and class of all Shares of the Fund beneficially owned by such Shareholder. The person presiding at the meeting, in addition to making any other determinations that may be appropriate to the conduct of the meeting, shall determine whether such notice has been duly given and shall direct that proposals and nominees not be considered if such notice has not been given.

IT IS IMPORTANT THAT PROXIES BE RETURNED PROMPTLY. SHAREHOLDERS THAT DO NOT EXPECT TO ATTEND THE MEETING ARE THEREFORE URGED TO COMPLETE, SIGN, DATE AND RETURN THE PROXY CARD AS SOON AS POSSIBLE IN THE ENCLOSED ENVELOPE.

In San Juan, Puerto Rico, this

17th5th day of

September, 2021.October, 2022.

|

| By Order of the Board of Directors, | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | Manuel Rodríguez-Boissén, Esq. Secretary | |

Secretary

| | | |

| | | |

| | | |